The 2025 Global Business Leader Agenda

December 18, 2024

Fast-paced and consequential events will make a shorter time horizon and a wider range of scenarios more useful for business planning this year. Timing business and investment decisions right will be important given the potential for big market shifts.

To that point, this outlook focuses on the first half of the year, and it concentrates on geographies instead of global trends. The second half of 2025 (let alone 2026) will look much different and is impossible to predict at this time.

2024 Global Business Leader Agenda: Sit Tight or Move Ahead?

January 2, 2024

As with recent years, geopolitics will dominate the headlines in 2024. Despite persistently slow growth in much of the world, falling inflation and interest rates will lower financial and economic risks and lessen geopolitical impacts. Moreover, the effects of many geopolitical drivers—the US election, policymaking in China, and the war in Ukraine—won’t become clear until 2025. Business leaders will have to reconsider near-term economic opportunities and geopolitical threats against the conservative, de-risking strategies that paid off for global businesses in 2023.

The Long View 2023 Lookback: The year exceeded expectations in many ways.

December 18, 2023

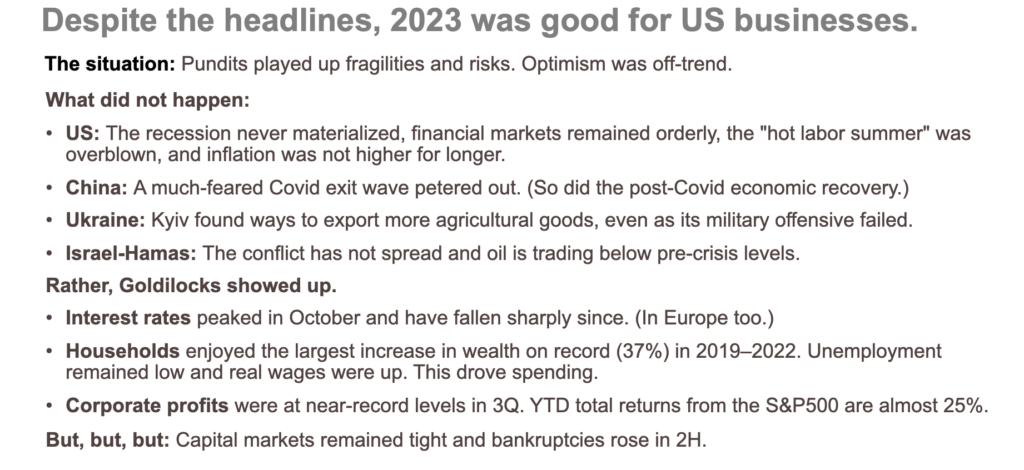

Optimism was off-trend in 2023, but the year ended up being much more positive for global businesses than forecasters and the headlines suggested.

Mid-Year Geopolitical Outlook and Business Leader Agenda

July 10, 2023

In the second half of 2023, geopolitics will continue to heat up while the economic narrative will remain very muddled. But we see some clear trend lines nonetheless. Economic risks, including inflation, are receding. In China, questions about long-term attractiveness will overtake hopes for near-term recovery. The escalation of fighting in Ukraine will elevate fears of a forever war (in the West and in Moscow) and catalyze efforts to end the violence and move Ukraine forward—into NATO and the EU. Geopolitics will force countries and companies to both de-risk and de-couple. ESG has reached its make-or-break moment. And, every company will become an AI enterprise, while business leaders will have to quickly sort out the opportunities, hype, and risks.

The Long View 2023: Big, foundational issues will shape the global business leader agenda.

December 8, 2022

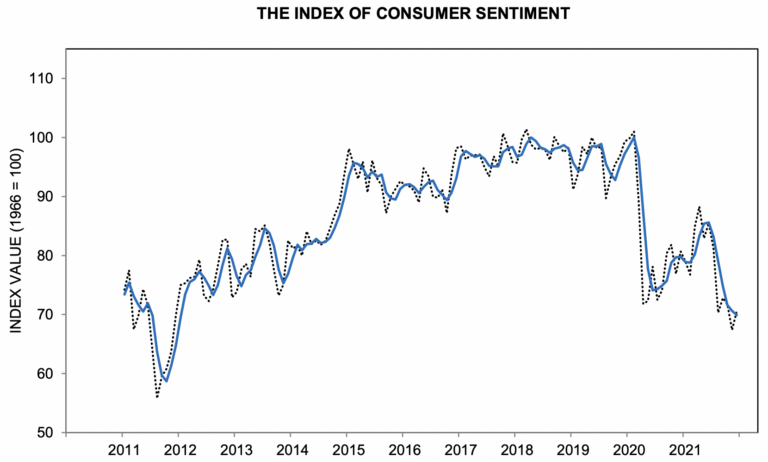

The world is in a macro moment. Uncertainty about the world's macroeconomic state—most importantly inflation, access to capital, consumer and market sentiment, and growth. Macropolitical dynamics will override micro policy issues, including political dynamics in China, Europe, and the US, and the futures of Ukraine, Russia, and Iran. Macro transformation will take precedence over micro-optimization. Sustainability, digitalization, and value chain reengineering require ambitious efforts, not fiddling. What this means for business leadership: Operating at two levels. Success will not only require keeping the enterprise going but also navigating big uncertainties and shifts in the macro field of play.

The Long View on the War in Ukraine: Risks to Russia

September 22, 2022

Russia started the war with a huge military and industrial advantage but its forces are now being pushed to their limits. Battlefield developments in the coming weeks will be pivotal for both countries. While Ukraine is at risk of much greater destruction, its people and government are unified. The Putin regime is experiencing repeated system failures and is showing signs of elite fracture that could lead to macropolitical destabilization.

In the Wake of Russia: Political Risk Management Guides for Business

March 1, 2022

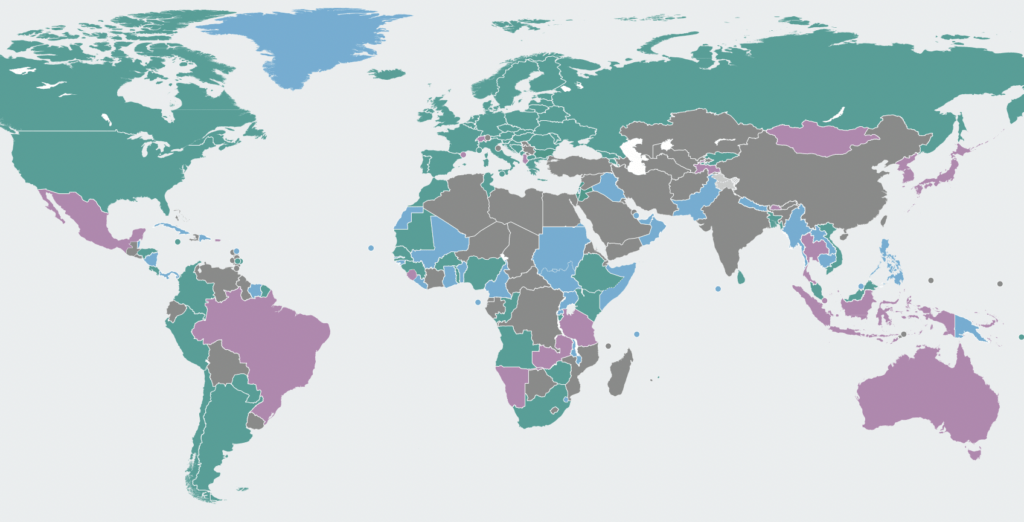

Russia's war on Ukraine, onerous sanctions, and corporate exits from the region shine a bright light on three forms of political risk (country risk, policy risk, geopolitical risk) that companies face in all emerging markets. Yet, business leaders and investors often say that it's hard for them to track risks in diverse markets around the globe. Drawing on over 15 years of advisory work, Longview Global Advisors produced one-page, practical guides highlighting issues to watch and questions to ask.

Get Longview's guide for Corproate Executives

Get Longview's guide for Corporate Directors

Get Longview's guide for Investors and Family Offices

.

The Long View: Issues to Watch in 2022

January 2, 2022

Many business leaders expected the world to move past Covid in 2021, but it didn’t. This brief pinpoints regions and questions to watch, what questions to ask about them, and what will become clearer in 2022. Topics include the sweet-and-sour mood in the US, the acceleration of climate action, rising risks in China, and the future of work.

The COP26 Climate Summit: Issues to Watch, Questions to Ask

November 1, 2021

Longview’s summit outlook explores past cooperation on the environment, key players and issues on the table, and the rhetoric. Regardless of concrete policy deals struck in Glasgow, the issues discussed at COP26 will reshape global markets—involving investment flows, advanced technology development, trade rules, and business leadership and strategy.

The Long View 2021: Awareness in a Dynamic World

December 17, 2020

This outlook presents key themes to watch in 2021 to regain perspective and awareness after a year of pandemic and political risk. Many themes Longview identified for 2020 remain equally or more pressing for 2021: inequality and social justice, innovation, sustainability, political risk in the US, the rise of China and geostrategic rebalancing, and the EU’s efforts to set a Europe First agenda.

The US Election: A Business Risk Assessment

October 1, 2020, updated October 26, 2020

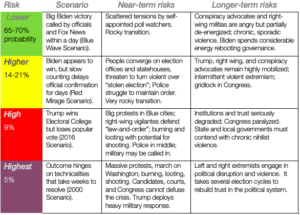

Election crisis scenarios have come to dominate discussions of American politics, but such thinking has been handicapped by a long history of political stability and notions of American exceptionalism. Longview applies an emerging market political risk assessment framework to the US and outlines implications for businesses. The analysis explores a full range of possible outcomes to reduce the potential for surprise—a need highlighted by the advent of COVID.

Five Forces Driving the World’s Political Risk Supercycle

Updated, November, 2019

The global political environment has been characterized as unprecedented, volatile, and dangerous—epitomized by an upsurge in populism and authoritarianism. This brief connects the dots and highlights 5 forces that are driving an enduring, global political risk supercycle: 1) slow growth, 2) inequalities in income and opportunities, 3) perceptions that governing institutions are unresponsive, 4) political entrepreneurs or insurgents, and 5) a hyperconnected social media environment. The brief also suggests three ways business leaders can respond to the threat.